EGC Newsletter

Rückruf von EGC

Email an uns

|

Introduction to private equity

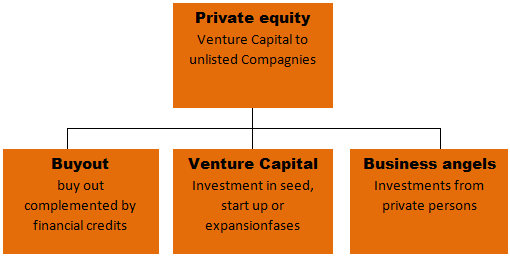

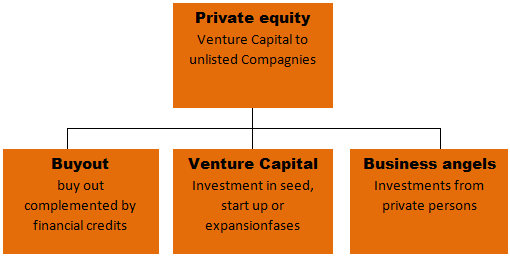

Private equity consists of investments in unlisted companies and buyouts of listed companies where the investor involvement is active, but limited in time. Private equity can be simplified into the buyout and venture capital-related investments, and investments being made by business angels.

Breakdown of private equity

Source: Swedish Venture Capital Association

Buyout means investments in existing, mature companies, such as through the purchase of a division from a larger group or buyouts of listed companies. Normally, the portfolio companies in the buyout-related funds good cash flows. Venture capital includes investment in small and medium-sized growth companies that are in seed, start-up or expansion financing, often with negative or weak cash flow. Individuals who invest in companies without their own family called business angels these are expected to have an active owner involvement, unlike other private investors. Common to the various categories is that investments are in companies where the growth and / or earning potential are good. ¹) ¹)

¹) Swedish Venture Capital Association

The Nordic private equity market

The Nordic private equity industry is in a positive phase. The total amount of available capital is increasing and a growing proportion of capital from international investors. It was a good environment for raising capital in the buyout industry and competition among investors to take part in the best funds was apparent. In addition, intensified private equity managers’ investments achieved with increasing competition for investment properties as a result.

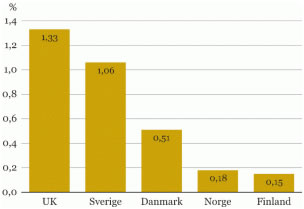

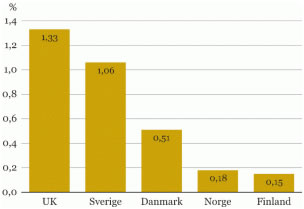

The Swedish market is the biggest in the Nordic countries regarding the size and growth. In 2005, Sweden after the Great Britain was the country with the highest percentage of invested private equity capital to GDP ratio in Europe. The Swedish private equity investments represented 1.06 per cent of GDP while the average in the Nordic countries was 0.45 per cent of GDP. 1)

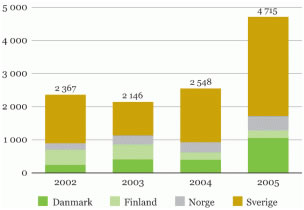

The amount of capital raised is increasing in all Nordic countries, approximately 90 percent of the Swedish buyout investments managed by the ten largest Swedish private equity managers. About half of the capital that investors committed to investing in the Swedish private equity funds managed by three operators, EQT, Industrial Capital and Nordic Capital1).The largest buyout operators are investing in all the Nordic countries and in some cases even outside the Nordic region. The operators whose investment size below 50 million per portfolio company operating mostly on a national basis. The amount of capital raised is increasing in all Nordic countries, except Sweden, where a slight decline was registered between the years 2003 to 2005. Exclusive of borrowed capital, administered June 30, 2006 a total of 31.6 billion euros by the Swedish private equity managers. The corresponding data for Denmark, Finland and Norway varies between 2.5 billion and 5.0 billion euros, of which, AUM, Sweden, Norway and Denmark, a total of 19.8 billion euros available for new investments. 2) 2)

Private equity investment as a percentage of GDP, 2005

Source: European Venture Capital Association

An estimated 90 percent of the Swedish buyout investments managed by the ten largest Swedish private equity managers, half of the capital that investors committed to investing in the Swedish private equity funds, are managed by three operators, EQT, Industrial Capital and Nordic Capital1

Although a considerable amount of capital managed in private equity funds, the number of employees in the industry should be limited in Sweden, total number of employees of investment managers to approximately 500 people The total number of investment managers of people in the Nordic countries is around 1 000. 3) 3)Investment Activity

Buyout players often act as catalysts for the company is in need to enter a new phase of development. For example, it can be one-divisions, which no longer belongs to the core business of a group, family businesses are facing a generation or undervalued public companies, whose development has stagnated A common feature of typical offer is that they often are well positioned in their respective industries, have strong cash flow and a clear potential for development. 4)

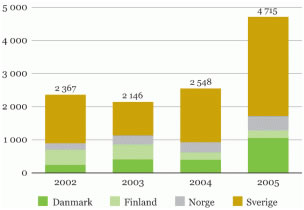

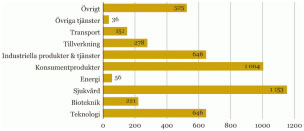

Unlike the other Nordic countries, Sweden is considered as an investment area to offer more investment opportunities in many sectors. In Denmark, it is particularly family-owned company investments are carried out and usually the average transaction value is less than in Sweden. The Norwegian business sector is dominated by oil and gas related business. Finland's proximity to Russia and Eastern Europe means that the investment opportunities offered by companies that benefit from the growth of the region. 5Sweden has the most number of investments and a substantially larger amount of invested capital as compared with the other Nordic countries. The overwhelming proportion, about 71 percent of the Swedish funds invested capital in 2005, the buyout investments. Approximately 45 percent of the Nordic private equity managers' investments were in sectors related to biotechnology and healthcare The Nordic managers' total investments amounted to EUR 4 715 million in 2005.

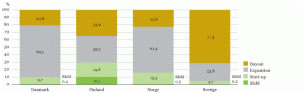

Nordic private equity investment manager, 2002-2005 (million)

Source: European Venture Capital Association

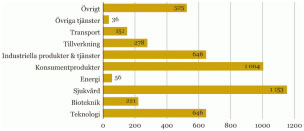

Nordic private equity manager's total investment by industry, 2005 (million)

Source: European Venture Capital Association

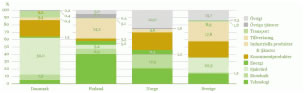

Nordic private equity investment manager divided among investment phase, 2005

Source: European Venture Capital Association

Nordic private equity manager's investment by industry, 2005

Source: European Venture Capital Association

1) The Swedish Venture Capital Association

2) Nordic Innovation Center, Nordic Private Equity - an industry analysis, November 2006

3) The Riksbank, "Venture capital companies in Sweden", 2005

4) The Swedish Venture Capital Association

5) 3i Buyouts Preview, Autumn

|

|